Investors and Funders

Stronger Children, Communities and Economies

Stronger Children, Communities and Economies

- Access to affordable, quality child care drives economic growth. It allows parents to work, supports businesses, and prepares children for future success.

- Capital is essential for child care entrepreneurs. By investing in businesses owned by LMI (Low-to-Moderate Income) individuals and those serving economically challenged families, we create a more prosperous child care sector and economy.

- Quality child care is an investment in our future. It fosters early learning and builds stronger children, communities and economies.

- First Children’s Finance Loan Fund provides the capital that brings child care dreams to life while creating brighter futures for families, businesses, and local economies.

Connect with Ericka Warmack, Director of National Lending

Ready to discuss your investment or partnership opportunities? Contact Ericka today!

Direct: 612-294-0083 Email: erickaw@firstchildrensfinance.org

Our Results

- Over $19 million in loans funded

- Over 700 loans

- Over 25,000 child care slots created or retained

- Over 4,000 child care jobs created or retained

Financial Strength

- Proven Track Record: With over 30 years of experience, First Children’s Finance Loan Fund has a proven track record of success.

- Low Loan Losses: Our historical loan loss rate has averaged 2.9% over the last 4 years, demonstrating our strong underwriting practices.

- Strong Portfolio Performance: With a 1.8% average delinquency rate over the last 4 years, our loan portfolio has minimal delinquencies and a strong repayment rate.

- Expanding Lending Footprint: Founded in Minnesota, we now serve child care businesses across nine states: Minnesota, Iowa, Michigan, Missouri, North Dakota, Oregon, South Dakota, Vermont, and Wisconsin .

- Strategic and Sustainable Growth: We are actively exploring strategic partnerships.

- Government Guarantees: We utilize government guarantees, such as the SBA (Small Business Administration) and MN DEED (Department of Employment and Economic Development) loan guarantee programs, to mitigate risk and enhance the security of our loan portfolio.

Flexible Investment Opportunities

We offer various ways for investors to partner with us and support our mission. To maximize our impact on the child care sector and ensure our long-term sustainability, we rely on a combination of debt and grant capital.

Debt Capital

Invest in our Loan Fund and directly finance loans to child care businesses. We offer competitive rates and flexible terms, and use government guarantees, like SBA and MN DEED loan guarantee programs, when applicable.

Grants: Loan Fund Essential Functions

Why Grants Matter: While debt capital is essential, it does not cover the full cost of running our Loan Fund or providing the extensive, time-sensitive support our borrowers need.

How Grants are Used

Grants support our essential operations, allowing us to:

- Invest in technology infrastructure

- Maintain a talented and committed team

- Develop effective programs

Increase the chances of success for child care businesses, by offering:

- Coaching

- Consulting

- Individualized guidance throughout the entire borrower journey

Types of Grant Support

We welcome grants for:

- Capacity-building

- Operations

- Technical assistance

- Pairing with our loans to borrowers

Program-Related Investments (PRIs)

As a foundation, align your investment portfolio with your philanthropic goals. PRIs can include low-interest loans and loan guarantees.

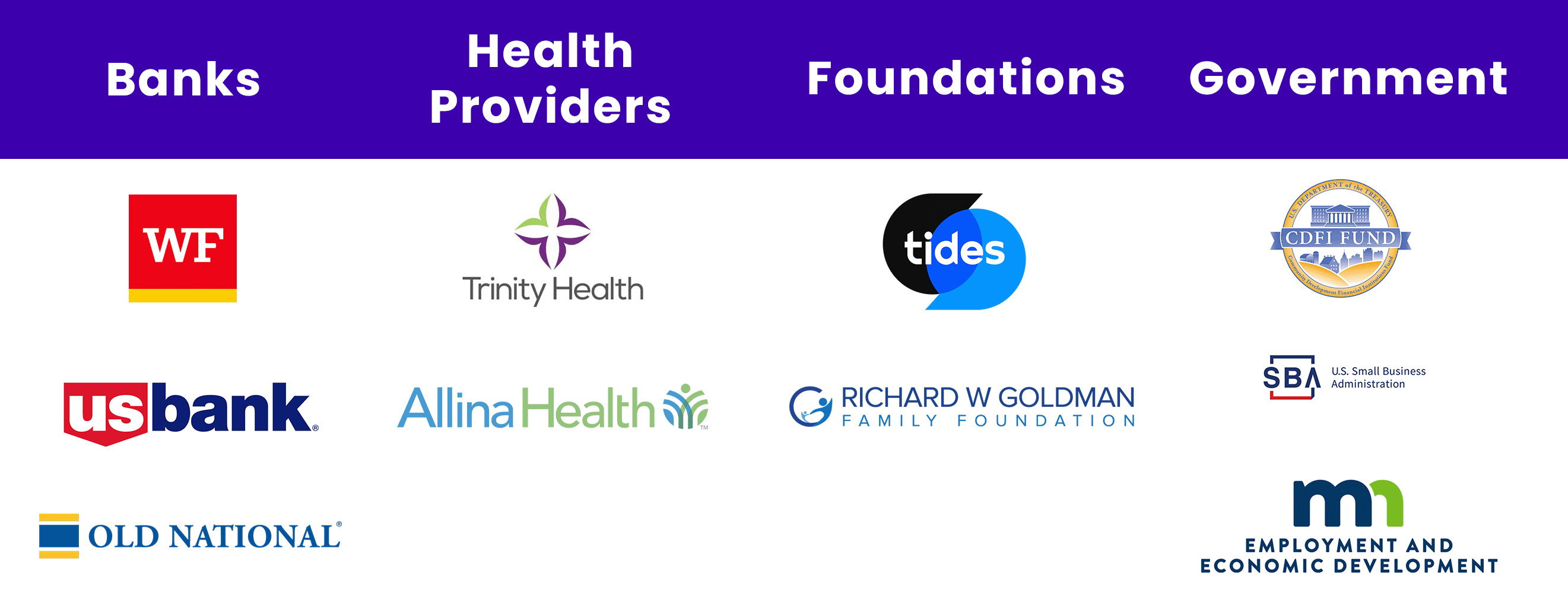

Our Loan Fund attracts a wide range of investors including:

Our investors are critical to our mission!

They help us:

- Finance child care businesses owned by LMI individuals and those serving economically challenged families.

- Expand access to quality child care.

Drive meaningful change by:

- Providing capital to child care entrepreneurs .

- Financing facility and program improvements.

- Partnering with organizations to improve availability of quality child care.

- Sharing our expertise to advance the field of child care finance.

Take the Next Step

Contact Ericka Warmack, Director of National Lending, to discuss how your investment can make a difference.

Direct: 612-294-0083

MN SBA Microlender SBA CA SBLC Guarantee Program – MN, MI, IA, ND, SD, IA, MO, WI Only